A Job-order Costing System That Relies on Normal Costing Will

Assign actual direct materials and direct labor costs to jobs. The job order costing system is a costing method that is used to calculate the costs attached to an individual job or order.

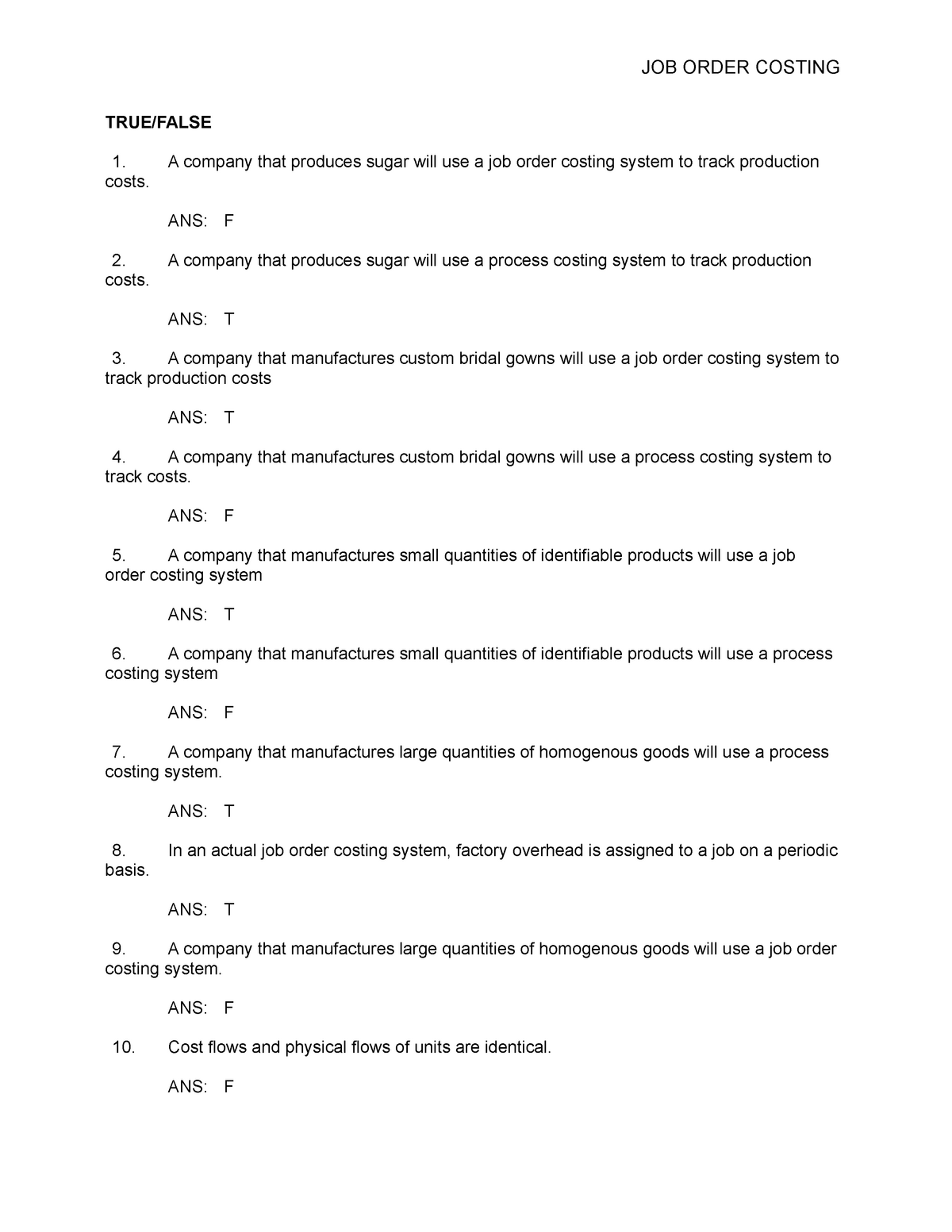

Job Order Costing Multiple Choices True False A Company That Produces Sugar Will Use A Job Order Studocu

Every business needs a way to track how much it costs to develop its products or deliver its services which in turn helps the business determine how to price the products and services for profitability.

. The job order costing system is used when the various items produced are sufficiently different from each other and each has a significant cost. To understand the flow of costs in job order costing system we shall consider a single months activity for a company a producer of product A and product BThe company has two jobs in process during April the first month of its fiscal year. June 21 2021 by Martin Luenendonk.

Process cost systems have a Work in Process Inventory account for each department or process. Multiple Cholce Apply overhead cost to Jobs by multiplying a predetermined overhead rate by the estimated amount of the allocation base Incurred by the jobs. Direct material direct labor and manufacturing overhead.

A process cost system process costing accumulates costs incurred to produce a product according to the processes or departments a product goes through on its. A job order costing system can be quite complex. Along with accurately recording costs by contract timely job costing is essential.

A job-order costing system that relies on normal costing will. Job order costing or job costing is a system for assigning and accumulating manufacturing costs of an individual unit of output. Assign actual direct materials and direct labor costs to jobs.

The actual costing system like the name implies is a costing system that traces direct and indirect costs to a cost object by using the actual costs incurred in the job. A normal job-order costing system is a system that uses. A job-order costing system that relies on normal costing will.

While each job represents a unit or a batch of products. Assign actual direct materials and direct labor costs to jobs. While each job represents a unit or a batch of products.

The Precast Department recorded 3950 machine hours in November. The key difference between job order costing and process costing is that job costing is used when products are manufactured based on customer specific orders whereas process costing is used to allocate costs in standardized manufacturing. It is a basic costing method which is applicable where work consists of separate projects or contract jobs.

One type of job-order costing is called actual costing. The per unit cost of a particular job is computed by dividing the total cost allocated to that job by the number of units in the job. The focus of a job order costing system is tracking costs per job since each job is unique and therefore has different costs relative to other jobs.

It must track information from multiple sources including the following. Job order costing is a system that takes place when customers order small unique batches of products. Payroll records from which the hours worked on a specific job are charged to that job.

Job costing or job order costing is the costing method in which company allocates variable and production overhead cost to the individual job. What is a job order costing system. The per unit cost formula is given below.

Apply overhead cost to jobs by multiplying an actual overhead rate by the estimated amount of. Job cost systems have one Work in Process Inventory account for each job. Job order costing is extensively used by companies all over the world.

Apply overhead cost to jobs by multiplying an actual overhead rate by the actual amount of the. When cost allocation is done in a timely manner management is able to make decisions on jobs on an ongoing basis. 30 Billed the state of Nebraska for the completed.

Job order costing and process costing are systems of collecting and allocating costs to units of production. Although this system is much more simplistic actual costing systems are not commonly found in real-world situations because actual costs cannot. Job 1 of 1000 units of product A was started in march.

In a business applying job order costing each job or order is assigned a job number to distinguish it from the others. A job-order costing system that relies on normal costing will. Without timely job costing management could miss an opportunity to identify unforeseen cost overruns that may require a change order to be applied.

Which of the following statements is. A job order costing system accumulates the costs associated with a specific batch of products or services. When a companys output consists of continuous flows of identical low-cost units the process costing.

A job-order costing system that relies on normal costing will. Apply overhead cost to jobs by multiplying an actual overhead rate by the estimated amount of the allocation base incurred by the jobs. Definition of job costing.

Per unit cost Total cost applicable to job Number of units in the job. Supplier invoices from which only those line items pertaining to a job should be charged to that job. Job costing is a costing method used to determine the cost of specific jobs which are performed according to the customers specifications.

Employees complete job order cost sheets for each order and usually separate expenses into three main categories. F204 Chapter 5 Job Order Costing 30 Applied overhead in each department. Inventory management just became much simpler with TallyPrime.

Actual costs for direct materials and direct labor and estimated costs for overhead if actual overhead is greater than applied overhead the variance is called underapplied overhead. Apply overhead cost to Jobs by multiplylng an actual overhead rate by the estimated amount. Depreciation was recorded on equipment 18350.

This system determines the price of each individual product and ensures that the cost for each product is reasonable enough for a customer to purchase it while still allowing the company to make a profit. Assign actual direct materlals and direct labor costs to jobs. Besides Job costing is a system of expense monitoring in which a business only creates products to fill customerclient orders.

Work in Process Inventory accounts. Costs related to each job are allocated directly to each specific job. A job order costing system uses a job cost sheet to keep track of individual jobs and the direct materials direct labor and overhead associated with each job.

Information Tracked by a Job Order Costing System.

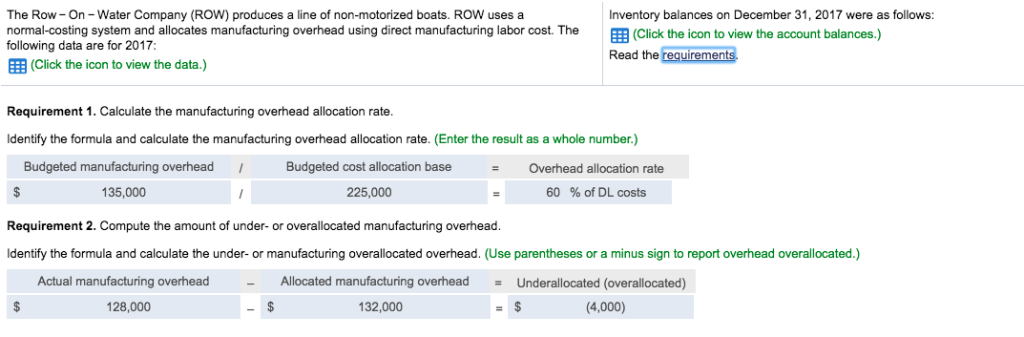

Solved The Row On Water Company Row Produces A Line Of Chegg Com

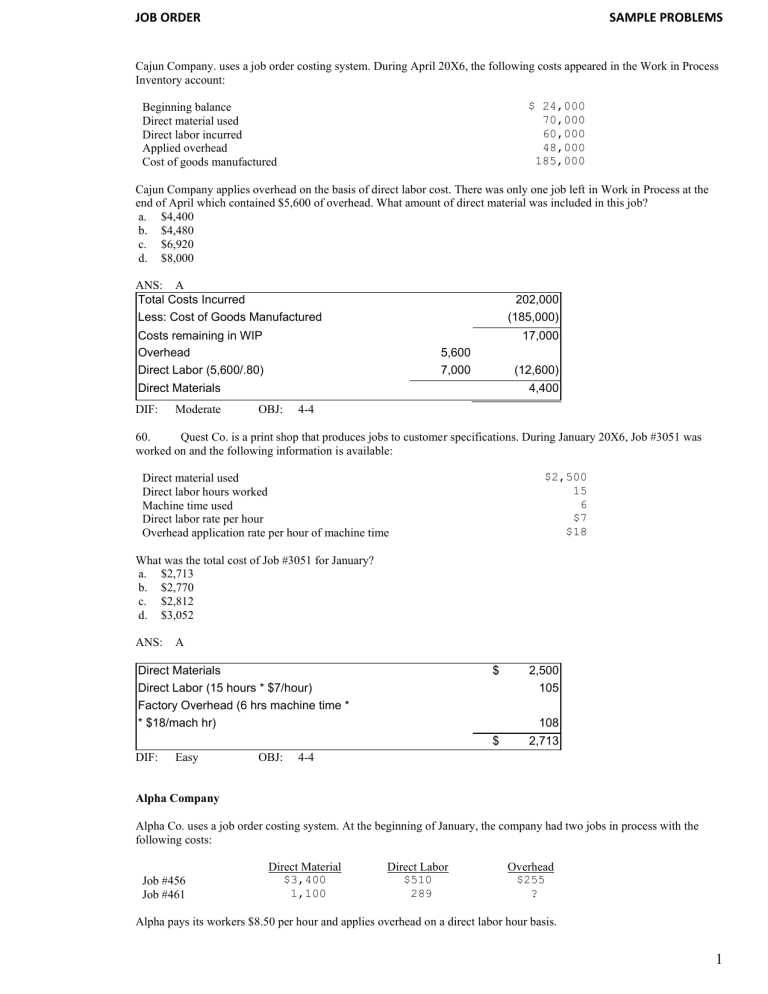

Job Order Sample Problem From Wiley

Which Of The Following Would Be Accounted For Using A Job Order Cost System In 2022 Accounting Job System

No comments for "A Job-order Costing System That Relies on Normal Costing Will"

Post a Comment